12h00 ▪

4

min at reading ▪

The Krypto market is currently experiencing a period of uncertainty, while bitcoins that have recently achieved historical heights show signs of weakness. Krypto and experts identified disturbing indicators indicating the possible upcoming lower phase.

Warning signals multiply on a bitcoin market

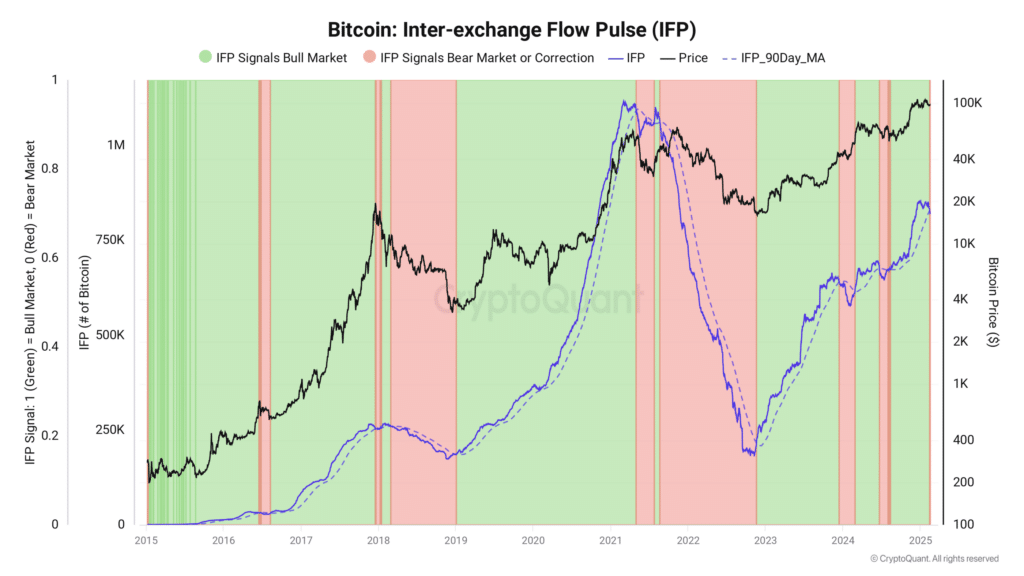

15 February 2025 was published by a platform for analysis of cryptocurrency blockchain revealing a report on the movements of bitcoins. The inter-Ex-Ex-Exchange Flow Pow (IFP) indicator shows a worrying trend: investors massively remove their bitcoins from the derivative trading platforms to transfer them to the exchange of spot. This behavior is historically associated with a reduction in the exposure to risks by the main investors.

According to Ja Maartunn, an analyst in the cryptocurrency, this movement is generally a sign of caution. When investors move their bitcoins to conventional platforms, they often protect against a possible price drop. On the contrary, during the period of increase investors tend to transfer their BTC to speculative platforms to maximize their profits.

Another disturbing signal comes from the history of IFP. In March 2021, this indicator reached a record level just before Bitcoin climbed $ 58,000. On the other hand, during the recent summit of $ 109,000 in January 2024, IFP remained surprisingly low. It is unusual because traditionally every new bitcoin record is accompanied by a new IFP record.

Macroeconomic context weighs prospects

The current situation of bitcoins is part of a complex macroeconomic context, especially in the United States. The latest inflation reports have led the American Federal Reserve (Fed) to maintain a caution, probably pushing its currency policy by 2025. This decision has a direct impact on risk assets such as bitcoins.

The conditions of global liquidity necessary to support the market crypto depend largely on these monetary policy decisions. Analysts suggest that permanent restoration of bitcoins will require a significant improvement in global liquidity conditions, which seems unlikely in the short term.

However, whales are the subject of increased analytics monitoring who seeks to identify reliable levels of support at the cost of bitcoins. Their behavior could provide rare traces for future market management.

In short, although technical signals indicate a possible correction phase, many experts maintain their optimism for a long -term bitcoin perspective. However, the combination of technical indicators and macroeconomic context raises caution in the coming weeks, especially for investors with a short -term investment horizon.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Passionate Bitcoin, I like to explore meanders blockchain and cryptos and share my discoveries with the community. My dream is to live in a world where privacy and financial freedom is guaranteed for everyone, and I firmly believe that Bitcoin is a tool that can make it possible.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.