11:00 ▪ ▪

3

min at reading ▪

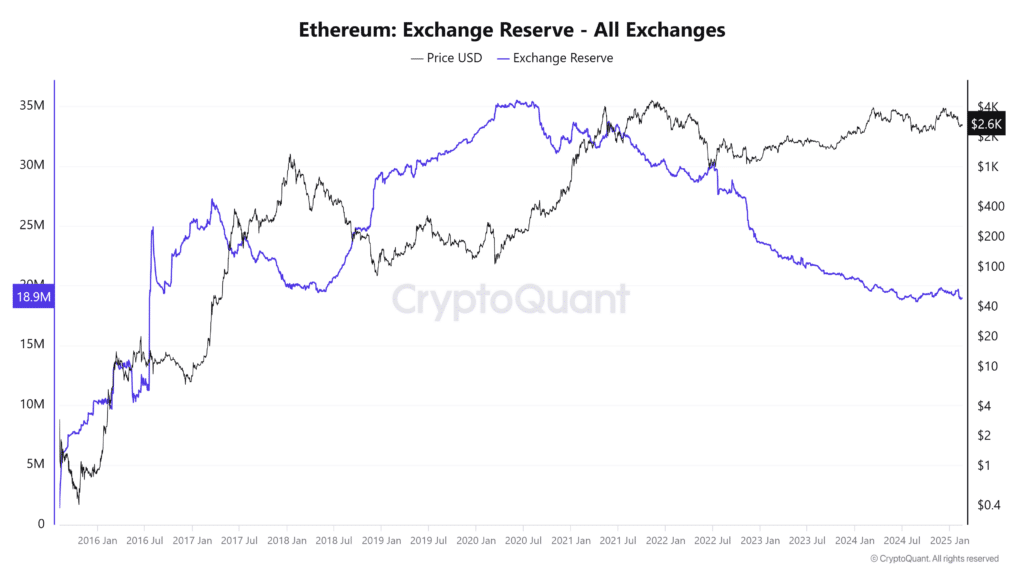

Ethereum reserves (ETH) on centralized exchange platforms have reached their lowest level for almost nine years and have aroused investors optimism in terms of possible recovery on the market. This reduction in the available offer could contribute to recovery to the psychological threshold of $ 3,000.

Notification Fall Ethereum Reserves Immediate Assembly?

According to recent data, Ethereum reserves have dropped to 18.95 million 18th February, which is an unprecedented level since July 2016. This decline suggests a change in the attitude of investors who now prefer to remove their assets from the exchange of platforms to maintain them in private private private or stuking wallets.

A decline in the Ethereum offer on the stock exchanges could cause the “supply shock” phenomenon (tender shock), where the high demand associated with a reduced supply leads to the valuation of the price. Historically, such episodes often coincided with a significant increase in prices.

In fact, when investors remove their Ethereum from stock exchange platforms, it means that they do not intend to sell in the short term. On the contrary, this suggests increased confidence in the future value of the asset, the typical behavior of the storage phases preceding ascending trend.

Towards Return Over $ 3,000?

The market seems to turn to the target of $ 3,000, which is a key threshold that, if exceeded, could mean the beginning of the new upper dynamics. Currently, the price of ETH is $ 2,685, far from the historical summit, but compared to recent volatility periods is increasing.

However, if the decline continues, the Ethereum could not only reach $ 3,000, but also exceeded $ 3,500 in the coming days. Market observers therefore carefully monitor these capital movements and look for warning signals of permanent recovery.

Therefore, the Ethereum reserves on the stock exchanges are a key indicator that investors could watch carefully. Especially for those who are trying to predict future prices’ movements in this volatile cryptocurrency market.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.