4:00

4

min at reading ▪

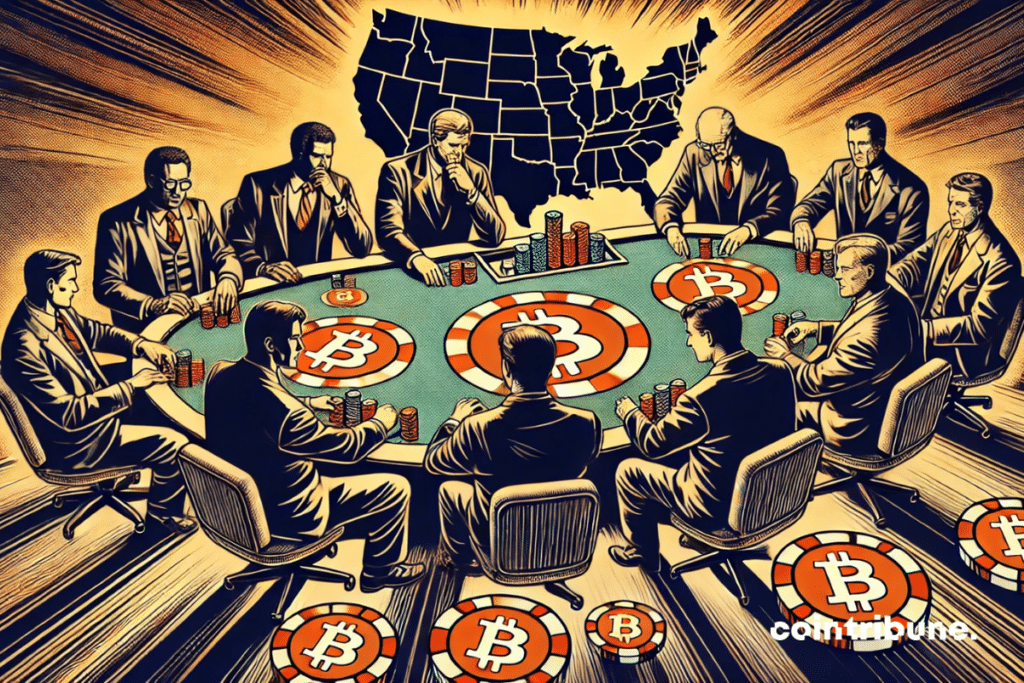

Bitcoin is still winning. This time, twelve US states talk about them, with a colossal investment of $ 330 million in the strategy, formerly Microsthegy. This movement is the main break in the integration of crypto into institutional portfolios.

Public pensions are suitable for strategy: victory at stake or expected risk?

American pension funds have never been so close to Bitcoin. Twelve countries have just revealed a massive $ 330 million participation in the strategy, the former microstrategies, and the economic watches’ company has been transformed into a giant BTC safe.

At the peak of Peloton in California, with more than $ 150 million divided among several public pension funds. The system of downloading teachers in California holds 285,785 shares of a strategy worth approximately $ 83 million, while a system of collection of employees in California has 264,713, a total of approximately 76 million. A double bet that makes California an institutional bastion of this digital gold fever.

Other countries followed movement such as Florida ($ 46 million), Wisconsin (29 million) and North Carolina (22 million).

Even New Jersey and Illinois took a position and described the progressive but significant acceptance of bitcoins in state financial strategies.

These investments show the growing confidence of institutions to the strategy model that, as we remember, currently holds 478,740 BTC, or about $ 46 billion at current prices.

Bitcoin by proxy: strategy, entry card for public funds?

With an increase of 383 % over the year, the Strategy Strategy has sprayed the Krypto market, which increased by only 62 % in the same period.

In these pension funds, betting on the strategy is to obtain an indirect exposition of bitcoins without having to directly control the detention of the asset. Malignant, but also risky strategy, because the volatility of bitcoin is legendary.

Last Stratum Shine? Acquisition $ 7,633 BTC between 3 and 9 February, for an average price of $ 97,255 per unit. A courageous bet that emphasizes the aggressive philosophy of Michael Saylor has convinced that Bitcoin is the future of value reserves. It remains to be determined whether this vision will be verified by a long -term market.

With these massive investments, the United States seems to initiate a strategic turn: rather than ignoring or fighting bitcoins, some public institutions prefer use. Adoption that can inspire other countries well to follow the movement. Because if recent history has taught us one thing, it is because when it comes to investment, Wall Street and the United States will never let the opportunity go through.

Vision of genius or institutional madness? The dice are thrown and bitcoins continue to nibble on the ground where they do not necessarily have to be expected. In this context, it is reported that on the basis of its part, it actively cooperates with US legislators to redefine the future of Stablecoins.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Evariste, fascinated by Bitcoin since 2017, has not stopped documenting on this topic. If his first interest focused on trading, he now tries to actively understand all cryptocurrency progress. As an editor, he tries to permanently provide high quality work that reflects the condition of the sector as a whole.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.