14:00

5

min at reading ▪

Bitcoin (BTC) continues to test the patience of traders while its price stagnates below $ 100,000. Between potential pressure up and symptoms of weakness on markets there are 5 key elements that need to be monitored this week.

5 Bitcoin Monitoring Signals This week: Danger?

This week promises to be decisive for bitcoins, with 5 important events that could completely redefine its trajectory.

1. Pressing Shorts and Increasing Bitcoins?

Since its historical record in mid -January, Bitcoin has been oscillated into a price range between $ 90,000 and $ 105,000 without converting $ 100,000 into solid support. Some traders believe that the next movement could be compression of shorts, forcing sales positions to redeem and cause a brutal increase.

Crypnuevo analyst underlines two key levels for bitcoins: $ 93,300 in case of correction and $ 99,200 in case of ascending disposal. Meanwhile, CJ trader focuses on $ 102,500 to $ 105,000 as a short -term ceiling, but warns that the return to $ 80,000 remains possible in front of the bull.

2. Perspectives of Fed and Macroeconomic

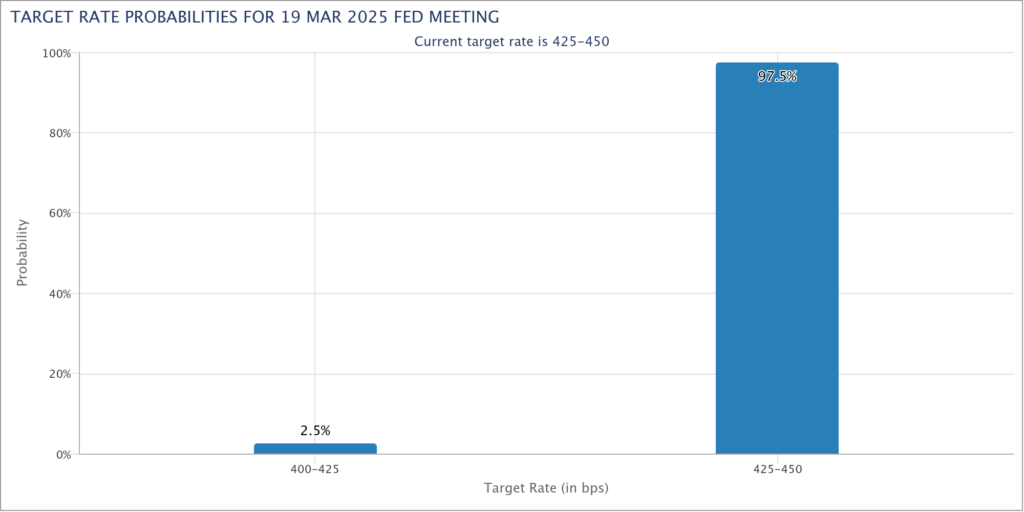

This week is also marked by the responsible economic agenda, in particular by publishing the Federal Reserve (Fed) records and new employment data in the United States.

Permanent inflation in March cooled hopes for lower interest rates. According to the latest data from CME Fedwatch, the probability of a reduction in 0.25 % is only 2.5 %. Stricter monetary policy could therefore slow the taste of investors to risk assets, including bitcoins.

3. Reduating the signal on the exchanged streams

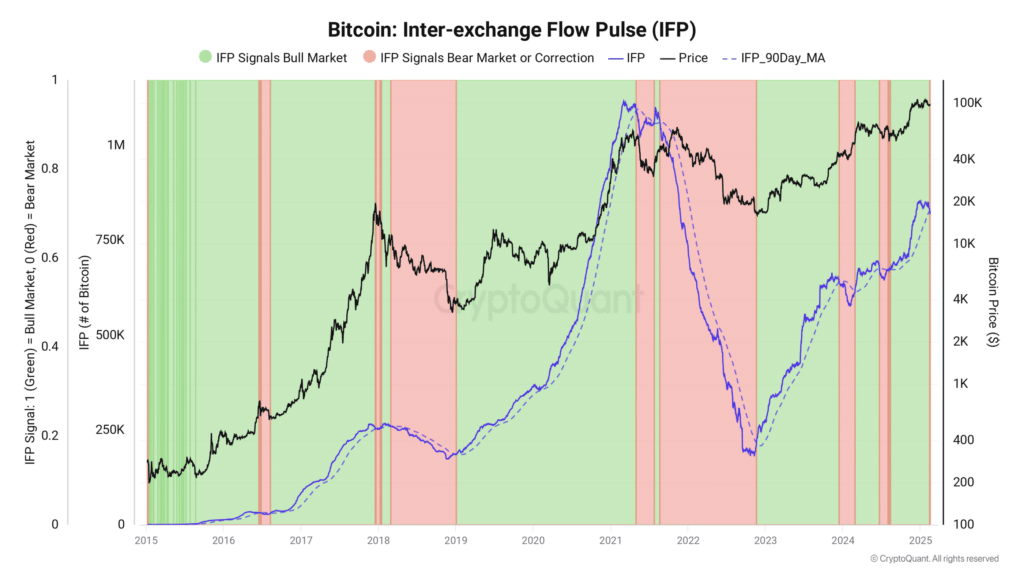

Bitcoins flow between point platforms and derivatives show a worrying change in trend. The inter-exp-Exchange Flow pulse (IFP) indicator has moved to a lower area and showed a reduction in exposure to the risk of investors.

Historically, IFP is preceded by the peaks of the market that has not yet been solved this year. According to the analyst Ja Maartunn, this situation could mean the beginning of the phase down, although other indicators remain positive.

4. A requirement always strong on bitcoins

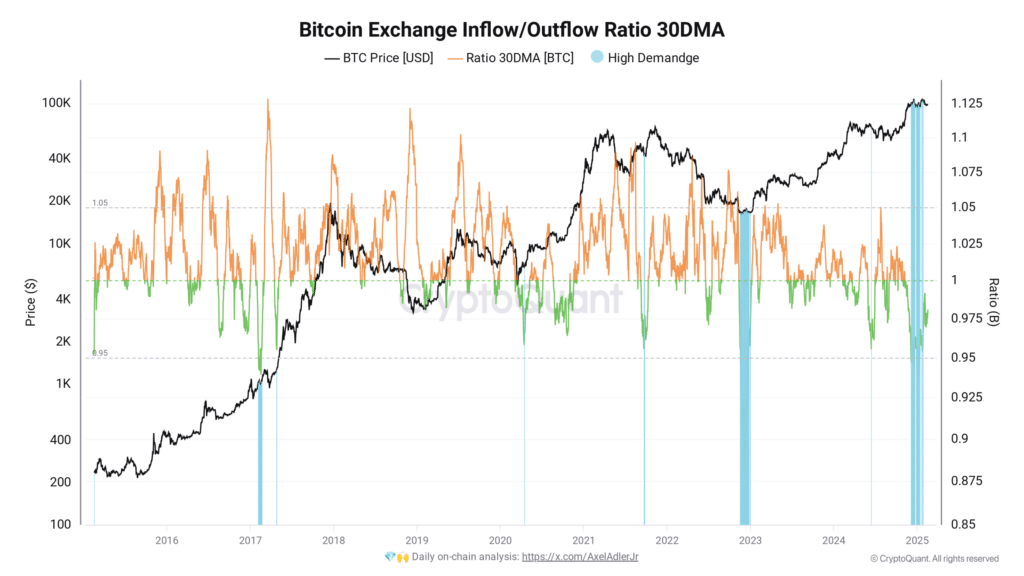

Despite the absence of a significant ascending trend, the chain data shows permanent demand. Darkfost analyst emphasizes the ratio of income and outgoing exchange of exchanges whose mobile diameter after 30 days is in the area of strong accumulation.

This trend suggests that investors continue to accumulate bitcoins, which could support the short -term price restoration. However, some of these flows could be associated with the transfer of assets for negotiated actions (ETF) and more offices (OTC).

5. The market flirts with “euphoria”?

An unrealized net profit/loss indicator (NUPL) in the long -term period shows that the market is entering the high profit phase. NUPL more than 0.75 traditionally refers to euphoria that precedes market summits.

During the previous bull cycles, this euphoria lasted 450 days in 2013 in just 228 days in 2021. If the trend is confirmed, this could indicate that the upper part of the current Haussier market is approaching.

A cautious and reactive approach

This week, traders and investors of bitcoins must accept a cautious and reactive approach. In the face of the uncertain market, it is necessary to monitor key levels, avoid too aggressive positions, and adjust strategies according to exchange flows and macroeconomic decisions, especially in the federal reserve.

Bitcoin therefore intersects the phase of uncertainty, compressing a short potential that could lead to a price of around $ 102,000 – $ 105,000, but also to reduce signals on exchanging streams. The development of inflation and monetary policy of the Fed will play a key role this week and those that come.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.